|

7 Tax & Spend |

It should be clear that under our basic premise, the self-ownership axiom, the removal of property from its owner against his will is a fundamental violation of his rights; a "garbage in" that is bound to lead to "garbage out." Such is taxation in all its forms. Yet taxation is the very lifeblood of government; additional confirmation, were any needed, that government is wholly irrational.

"Tax & Spend" is the heart of the business of government and always has been; though it was not until the "New Deal" of the 1930s that its spokespersons were honest enough to say so openly. The full quote is: "Tax and tax, spend and spend, elect and elect!" by one of President Franklin D Roosevelt's closest aides, Harry Hopkins. The idea was (and is) to maximize taxes from all and to spend what is collected on segments of the population where it will most likely yield votes favorable to the ruling party, so helping perpetuate its rule.

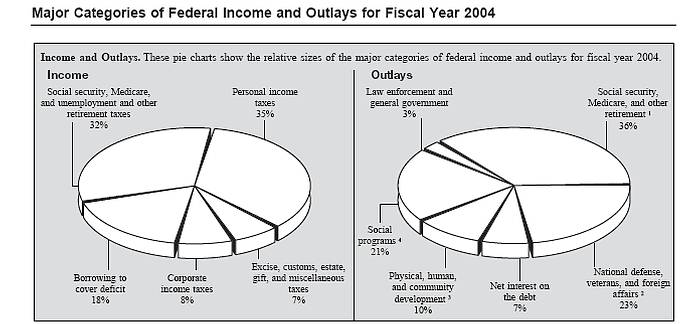

Here is the tax & spend summary for the Federal Government, for the year 2004. The size of the pie was about $2.3 trillion and that will rise with time, but the proportions are rather stable. They may not change much in the next couple of decades, except that the "social security system" is likely to increase in both its taxes and spending, as the population ages:

In addition of course there is taxing & spending by Town, City and State; hard to estimate, but probably more than as much again as those of the Feds. All together, governments steal and spend nearly half of all that Americans earn, and have done since the 1960s.

The most striking feature of the Federal pie charts is that "Law enforcement and general government", generally seen at the irreducibly essential activities of government by those who have not studied TOLFA Segments 2 and 6, absorb only 3% of the spend. "National defense..." takes up another 23%, and that too is mistakenly seen as something government must do (see the Segment on "War") and so at least 74% of the entire Federal spend is spent by their own admission on activities not part of that supposedly irreducible minimum. Three quarters!

After deducting the 7% spent as "interest on the debt" - the debt accumulated by decades of overspending - we have 67% of the whole Federal spend - two thirds, by their own admission - going on such catch-all euphemisms as "physical, human and community development", "social programs", and "social security, medicare, and other retirement" programs; in 2004 dollars, over $1,500,000,000,000. Even if the "defense" expenditure was essential to defend the Union against imminent threat, that gargantuan figure is what the Feds alone spent on redistribution, so as to curry favor with voters: "Tax & Spend."

Let's have a quick check on the nature of the beast, before we look more closely at what taxation is, and at how a free-market society would distribute wealth. Question: where do politicians spend most of the money they collect as taxes?

1. The Nature of Taxation

Let's first amplify the opening sentence of this Segment. The axiomatic right for every person to own and operate his own life means that any and all actions a person takes are his too, along with their consequences; so for example if he carves some driftwood into a chair, that chair is his property; he has as good a right to own that chair as he does to own his person and life.Let's take the logic a step further: if he decides to make another chair and, since he's able to sit on only one chair at a time, to sell the second for some medium of exchange (with which he might buy food or clothing) then the proceeds of that sale are also absolutely his, and nobody else's. And so are any objects he may buy in addition to consumable food, such as a bicycle; all are his exclusive property, as much as he is his own self-owner. "Property rights", in other words, derive directly from the right to life and are just as immutable.

In market transactions like those just mentioned he may contract to exchange property, on a basis that is strictly voluntary on all sides. We saw in Segment 3 how this leads to an increase in overall wealth, because everyone has an unique scale of values; some prefer a chair to a bicycle, some vice versa. "Price" is a mechanism for ensuring that all such exchanges are "fair"; that is, the exchange occurs only if both parties are willing to pay or accept the price agreed.

But taxation is not an agreed price; it is a removal of property without the essential element of voluntary agreement. It is, therefore, theft - an outright violation of fundamental rights. To steal some of a person's property is to steal some of the person.

Government spokesmen try to disguise this ugly truth by pleading that taxing and spending brings some benefit to society. Here are some common examples.

- "Taxes pay for essential services that only Government can provide." This embodies a fatal contradiction: if some service (postal delivery, for example) were truly essential, the market would certainly

find a way to provide it, so as to make a profit; and customers would not need to be compelled to pay for it,

they would do so willingly. This claim is totally specious.

- "Government can spend and invest wealth more wisely than the citizens." This astonishing

claim holds that people who live as parasites on the honest earnings of others are wiser than they are at

investing what they earned! Nobody has ever found a shred of evidence to support such an unlikely claim;

it's ludicrous on its face, and the economic history of the Soviet Union proves that in practice - as do

the fourteen miserable years of the American Great Depression, 1931-1945, during which government tax &

spend prolonged what

would otherwise have been a two-year stock-market hiccup.

- "Taxes enable Government to redistribute wealth more fairly" - sometimes on the false basis

that market transactions leave winners and losers; as we saw in Segment 3, in a true market there are no

losers, only winners. Consequently it's impossible to distribute wealth "more fairly" than the outcomes of

voluntary market transactions do.

- "Taxes are required to balance the economy." This claim is based on another false premise: that

a free market is inherently unstable, and therefore needs some kind of "damping mechanism" like tax,

to prevent wild swings or "exuberant enthusiasm" this way or that. The exact contrary is the case; there

is no more stable system than a free market, for nobody in a market can spend more than he owns. In the

pie charts above is shown the fact that routinely, governments are those who spend regardless of what

they actually have available; in fiscal 2004, they overspent by 18%! - and the 7% "interest on the debt"

indicates a cumulative overspend of two or three times one entire annual budget! Tax-funded government is therefore the source of economic instability, not its cure.

- "Taxes are the price we pay for civilization." This is perhaps the sickest claim of all, and the most common. The totally false premises are that what taxes buy can be called "civilization" and that absent taxes and the governments they fund, society would be uncivilized. The opposite is true for both. In the inimitable words of A I S Alexander, "Taxation violates the natural rights of everyone. Taxation is legalized theft. Taxation distorts the Marketplace and wastes time and resources. Taxation creates an elite class of political favorites who feast at the public trough and fence the stolen wealth, and a massive underclass of political victims who are coerced to subsidize this cannibalistic process. Taxation pits man against man, and group against group, as everyone struggles to regain what he has lost - but which has been squandered and cannot be regained. Taxation requires an immoral bureaucracy to terrorize innocent citizens. Taxation is tribute that the citizens are forced to pay the bureaucratic robber-barons. And taxation is the ultimate means which enables the politicians to wage war." Some civilization!

2. Wealth Distribution in a Free Society

The beauty of a free-market society is that every penny of what everyone earns reaches him or her by voluntary agreement. If you don't want to pay the offered price for some item or service then you don't do so - you do without; because you prefer to do without than to paying the price! Participants always win, therefore; everyone always gets what he prefers.Should it happen that a manufacturer of $200 hammers finds that far too few people buy at that price to yield him the profit he seeks, he will lower it until they do. Standard business procedure! Only if he completely miscalculated market demand (at his own risk, notice) will he lose; provided the price at which his stock of hammers will sell is higher than what it cost him to make or buy them, he will gain.

From this comes a key principle:

| Those who best satisfy the needs and wants of other people will earn the highest reward. |

"Reward" means either profit or salary; businesses that serve their customers best will make the most profit, and employees who give the best value to their employers will earn the highest salaries. All this is true provided that no third party interferes to redistribute what is earned, through taxes that punish the most productive, and is a truly elegant result of the free market. Nothing could be more fair than that!

But what, some may ask, of the unfairness that some people, being extraordinarily talented or hardworking, may become "filthy rich"? - again, since every penny was earned by voluntary exchange, the premise is absolutely false: it is not unfair in any degree!

Still what, they insist, of the unusually UNtalented, or bone idle. Will they not starve to death?

There is nothing inherently unfair in letting starve those who will not work - who are too proud to offer service to their neighbors in exchange for food or money; on the contrary, that is perfectly just. The alternative is to steal from their neighbors, violating their self-ownership right - and that would indeed be grossly unfair. Still, that does leave the question of those unable to work.

Recall that the essence of all free-market transactions is that they are voluntary. Normally there will be an exchange; but so long as they are voluntary, there need be no exchange. This is called a "gift." Arguably, the giving of a gift brings its own reward in exchange, in the warm feeling of self-respect that results. Whether that's so or not, gift-giving is a time-honored practice of human beings and a perfectly sound component of a free-market society. It may be called "charity" and the gift of help to someone unable to cope for himself is a very commonplace activity even when government steals massive sums of money on the false promise of spending it to help the poor. In periods of lower taxation, charitable and well directed giving was even more potent. So it will be again, and more so, when society becomes entirely free.

3. Segment Review

In Segment 7 we've demolished the fiction that redistributing wealth, the central activity of government as revealed by its own statistics, is in any way necessary or desirable; that on the contrary, whatever distribution results from operations of a free market is in fact the fairest, most desirable one possible.Let's wrap it up by some Qs and As as usual, to ensure we're still on the same page; if any seem hard, please discuss it with your Mentor before moving to Segment 8 - and do spend time in "Further Reading", especially the articles with free on line access.

For further reading:

Compassion in a Free-Market Society

Your Tax Dollars at Work

Taxation as Rape

Dog Bites Man

"America's Great Depression" by Murray Rothbard